Starting your own business requires a lot of courage and involves some risk. It helps you to step outside your comfort zone and experiment. The independence, happiness, and flexibility that startups provide are the significant factors that motivate most people to join them.

However, a recent study found that over 95% of new businesses fail during the first year of operation. It is primarily due to a lack of financing changes. Therefore, you need money to maintain your business at all times.

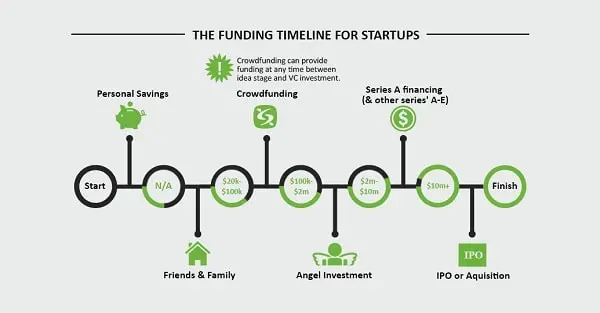

Further, as a business expands and begins to amass a greater market share or clientele, it becomes important to raise additional funds to support its expanding commercial goals. And to raise money, the startups go through many startup funding stages.

There are multiple types of funding for startups available. However, the amount of capital often depends on the startup’s stage of operation.

A Startup Can Be In One Of The 7 Stages When It Is Looking For Funds:

⦁ Incorporation round

⦁ Seed round

⦁ Angel round/venture capital round

⦁ Series A round

⦁ Series B round

⦁ Series C round

⦁ IPO

1. Incorporation Round / Friends and Family Round

Capital is mainly required for a startup to set up the business, create a working prototype of the service or product and start operations.

However, the capital requirement may be relatively modest in the early stages, so you might ask your friends and family to invest in your business. At this point, the startup’s overall valuation typically ranges from $10,000 to $100,000.

If not, you can bootstrap your business or finance it yourself. Bootstrapping is more than growing your company with little to no outside funding. You won’t be pressured to repay the money at this time.

2. Seed Round

This initial step of startup fundraising is where an outside vendor provides the investment. The funding will be used for hiring additional staff, marketing campaigns, product launches, and product-market fit studies. The capital can range from $3 million to $6 million. So, most companies approach incubators and seed investors to raise money.

3. Angel Round/Venture Capital Round

The company is currently displaying steady growth. Money is required to expand businesses, access new markets, develop products, etc.

So, the startups approach Angel investors and venture capitalists for startup fundraising. Typically, wealthy investors, investment banks, and other financial organizations provide the initial stages of venture capital financing.

These stages of venture capital entail several funding rounds or a series that includes Series A, B, C, and D. These startup funding stages raise more money and boost their valuation. The startups can raise between $10 and $30 million.

4. Series A Round

The initial venture capital money has been used to start the business. The business is committed to product development and is required to give investors preferred stock.

The startup must diversify its business at this point and expand. To improve the business, a lot of capital is needed. The current fundraising total is roughly $15 million.

5. Series B Round

You can use advanced market research techniques at this level to gain market share and create operational teams for things like business growth and marketing. Startups may raise about $30 million to meet their demand.

6. Series C Round

The business has progressed well to this point and may consider going global. The money raised here will help develop new goods, expand into new markets, and acquire struggling firms in the same sector. The beginning budget may be between $100M and $120M.

7. IPO

In this last phase, the firm shares are initially made available for purchase by the general public. In this stage, the business raises money for future expansion, assembling a team of SEC specialists, attorneys, and accountants, preparing financial statements for an adult audience, and more.

You must follow these startup funding stages if you want your business to be successful. Further, knowing where their firm is situated and which possible financial experts would invest resources in the company to help it grow and flourish is helpful to the business owners.